Sherwood QLD 4075

5x bed residential dwelling on an individual title on a 2,728sqm allotment.

Term

12 months

Target Return

8.25%

LVR

64.62%

Access first mortgage opportunities with monthly yields and balanced growth and stability.

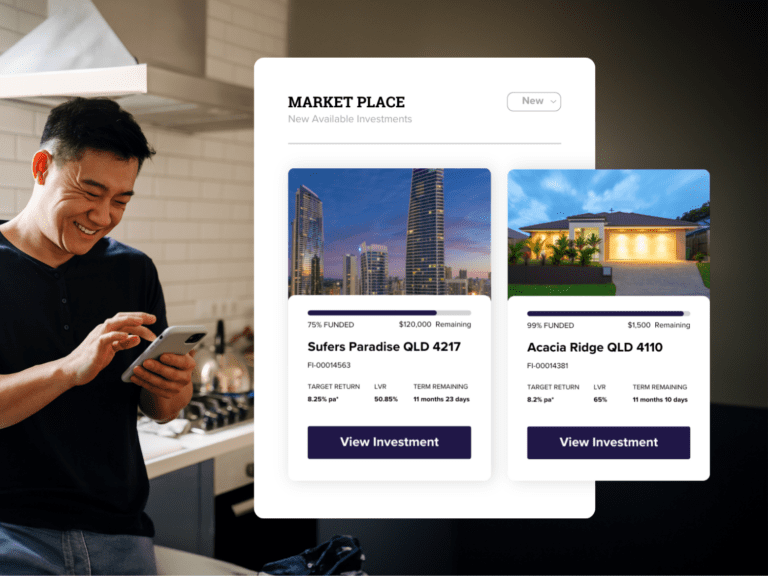

The Funding Investment Trust (ARSN 616 185 276) makes investing in markets previously dominated by big banks and wealthy institutions accessible to everyday Australians. With a minimum investment of $5,000, you can enter the Australian mortgage market through our innovative investor platform. Take control of your investments and choose from a variety of first mortgages based on loan term, property location, and target returns ranging from 5% to 9% p.a.*

Enjoy monthly interest payments and the flexibility to diversify across multiple, first-mortgage investments for balanced growth and stability.

Through our innovative investor platform, you can access features like account management, fund deposits, withdrawals and statements at a click. Explore new investment opportunities and stay updated with the latest funded loans.

We take great care in selecting borrowers who meet our stringent lending standards and robust underwriting criteria. Each borrower is approved by our experienced credit committee; providing investors with peace of mind.

Ready to join our community of savvy investors empowered to take control of their financial future? With our mortgage marketplace, it's easy.

Sign up quickly and easily. Create your free account in less than two minutes. Get started now or call 1300 44 33 19.

Add funds to your account. Your money is held securely in Trust until you're ready to invest.

Access our marketplace any time. Select, invest and manage your investments with ease.

Our investments are backed by a registered first mortgage loan against Australian real estate. A first mortgage is a first charge over real estate owned by the borrower. If there is a Default in repayment of the Loan, the property can be sold in order to recover the Loan and repay Members.

The security property varies from loan to loan however each loan is secured over either Residential or Commercial real estate in locations across Australia.

Borrowers must have Australian real estate security, the ability to meet their repayments and a repayment strategy to exit the Loan at the end of the term. Our mortgages are catered to borrowers that need a fast and flexible solution. Short-term mortgages are more expensive than traditional finance, which is why we are able to provide higher returns to our investors.

Once an investor has signed up and is approved, they can select, invest and manage their investments via our platform and professional management staff. An investor can choose to fully fund a Loan or invest alongside other Members in a particular Loan.

The Funding Investment Trust is the legal structure behind the platform. The Funding Investment Trust (“the Trust”) is an ASIC registered (ARSN 616 185 276) managed investment scheme where members of the Trust are provided with access to first mortgage investments.

Manager: Funding.com.au Pty Ltd ACN 603756547, AR No. 1239776

Trustee: Melbourne Securities Corporation Ltd ACN 160326545, AFSL428289

Custodian: Sandhurst Trustees Limited ACN 004 030 737

You can download the Product Disclosure Statement (PDS) by clicking here.

The loan to value ratio or LVR is the maximum lend secured over the property. The LVR is specific to the individual mortgage selected by the investor however the LVR must be less than 70% of the value of the security property. (e.g. Loan of $480,000 divide by Property Value of $800,000 = 60% LVR)

The interest from your investments is intended to be paid monthly, into your online Funding account, subject to the performance of the investments. From there you may choose to reinvest these funds or withdraw to your nominated bank account. Please allow for 2-3 business days for withdrawals to be processed.

The applicable rate of return for your investment is based on the performance of the Fund, based on the underlying loans. The return will be impacted by the interest rates paid by underlying borrowers (determined based on LVR, property location and other factors), performance of those loans, any borrower defaults and the fees charged in the fund. The PDS describes the target rate of return for your investment. However, this is a target only and may not be achieved.

Refer to our Privacy Policy for information on how we collect and store your personal information.