I invested $5,000 with Funding initially as a trial and have been with them now for over one year during which time I increased my investment with them. I have a personal consultant who has always responded to questions immediately – whether by phone or email. I am totally satisfied with their process and have been repaid as various investments ended with interest. They are prompt, and I have never had cause to chase anything, which encouraged me to increase my investment with them. There have been no hiccups whatsoever.

Invest in diversified pooled mortgages

Access a fund designed for passive income and capital preservation.

7.75% - 8.25% p.a.

2015

Zero

$1bn+

1600+

5700+

Enhance your portfolio with secure income opportunities

Reliable income with pooled Australian first mortgages

For wholesale and sophisticated investors, Funding offers our Income Trust with flexible terms. Starting from a minimum investment of $50,000, you have the choice of two investment options: a 6-month term or a 12-month term. Both options provide access to the Australian mortgage market through a pooled first mortgage investment fund, allowing multiple investors to join forces and fund a diversified portfolio of first-mortgage assets. These mortgages not only serve as security for the loans but also offer ongoing returns targeted from 7.75% to 8.25% p.a.*

Flexible terms to suit your goals

For investors after flexibility, our Income Trust offers two options: a 6-month term and a 12-month term. With the 6-month term, investors can target a return of 7.75% per annum*, while the 12-month term offers a targeted return of 8.25% per annum*.

Creditworthy confidence

We take great care in selecting borrowers who meet our stringent lending standards. Each borrower is approved by our experienced credit committee. This reduces risk and provides our investors with peace of mind.

Funding Income Trust

** As at 28 February 2025

How to get started

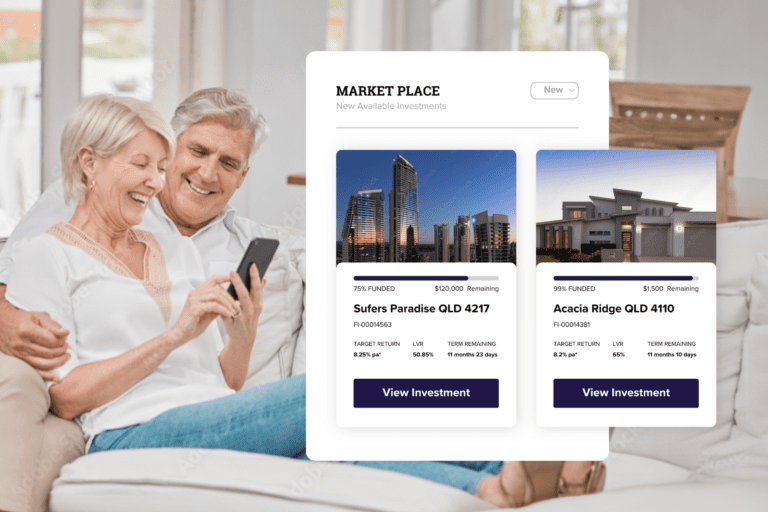

Ready to join our community of savvy investors empowered to take control of their financial future? With our mortgage marketplace, it's easy.

Submit application

Complete the online application form.

Transfer funds

Set up your payment and simply email us a copy of your payment confirmation.

Start investing

Once your funds are received, you'll be informed, and your investment journey with Funding has begun.

Securing stronger financial tomorrows

Discover the Funding advantage

Monthly yield potential

Property-backed

Flexible

terms

Diverse investments

Partner with Funding

Empower your clients with fast and flexible financing

Your questions answered

If you invest at least AU$500,000 in the Funding Income Trust you are automatically classed as a wholesale investor.

You also qualify as a wholesale investor if you provide a certificate by a qualified accountant stating that you have net assets of at least AU$2.5 million or gross income for each of the last two financial years of at least AU$250,000. A certificate issued by an accountant is valid for up to 2 years.

(Note – if you are contemplating an investment in the Funding Income Trust, you will find the accountants certificate in the Application Form.

You will need to give 90 days notice from the end of the current investment period to make any redemptions. You can not redeem an amount that will leave less than $50,000 remaining in your account unless you would like to redeem your full balance.

Our investments are backed by a registered first mortgage loan against Australian real estate. A first mortgage is a first charge over real estate owned by the borrower. If there is a Default in repayment of the Loan, the property can be sold in order to recover the Loan and repay Members.

The security property varies from loan to loan however each loan is secured over either Residential or Commercial real estate in locations across Australia.

Borrowers must have Australian real estate security, the ability to meet their repayments and a repayment strategy to exit the Loan at the end of the term. Our mortgages are catered to borrowers that need a fast and flexible solution. Short-term mortgages are more expensive than traditional finance, which is why we are able to provide higher returns to our investors.

The Funding Income Trust is the legal structure for our Pooled Fund. The Funding Income Trust is an unregistered managed investment scheme where members of the Trust are provided with access to first mortgage investments.

Manager: Funding.com.au Pty Ltd ACN 603 756 547, Trustee: Funding Capital Pty Ltd ACN 639 230 345, AFSL 523247

and Custodian: Sandhurst Trustees Limited ACN 004 030 737

You can download the Information Memorandum (IM) by clicking here.

The loan to value ratio or LVR is the maximum lend secured over the property. The LVR of mortgages within the pool may vary, however, all LVR’s must be less than 70% of the value of the security property. (e.g. Loan of $480,000 divide by Property Value of $800,000 = 60% LVR)

The interest from your investments is intended to be paid monthly, into your investment account, subject to the performance of the investments. You can elect to have these funds automatically reinvested, or withdraw to your nominated bank account. Please allow for 2-3 business days for withdrawals to be processed.

Providing the loans in the Trust perform as per the mortgage contracts, the target rate is currently 8 – 8.5% pa (net of fees)*.

Confidence grows with knowledge

Move Forward Faster