What is a bridging loan?

In this guide, we’ll explore how bridging loan rates work, what factors affect these rates, and how Funding’s Bridging Loans can offer property buyers the flexibility they need at competitive rates.

A bridging loan is a short-term loan that provides buyers with immediate funds to purchase a new property while they await the sale of their current property. Bridging loans are ideal for those who want to buy a new home or investment property without waiting for their existing property to sell. The loan is usually repaid once the current property is sold, making it a valuable financial tool for buyers who need to act quickly.

Key features of bridging loans:

Short-term solution: Usually lasts up to 36 months, allowing buyers to transition smoothly between properties.

Interest-only payments: Often borrowers only pay the interest portion during the loan term, with the principal repaid once the current property is sold.

Flexible repayment options: Borrowers can typically repay the loan by selling their property or by refinancing.

Understanding bridging loan rates

Bridging loan rates differ from standard home loan rates due to the short-term nature and higher risk associated with these loans. Lenders may charge a premium for bridging finance’s flexibility and quick turnaround. These rates can vary depending on the lender, loan structure, and borrower’s financial situation.

Factors that influence bridging loan rates

Several factors can affect the interest rates offered on bridging loans:

Loan-to-Value Ratio (LVR): The Loan-to-Value Ratio (LVR) represents the size of the loan compared to the value of the property being used as security. The higher the LVR, the riskier the loan is for the lender, which could result in higher interest rates. Borrowers with a lower LVR, meaning they are borrowing a smaller percentage of the property’s value, may be able to secure more competitive rates.

Property market conditions: Current property market conditions can influence interest rates on bridging loans. In a hot property market, with rising prices and strong demand, lenders may be more flexible with their rates. However, in a slowing market, they might adjust rates higher to mitigate their risk exposure.

Creditworthiness of the borrower: Lenders will also assess the borrower’s creditworthiness when determining the interest rate. A borrower with a good credit score, stable income, and a strong repayment history may be offered more favourable rates. Conversely, a borrower with a higher risk profile may be charged higher rates to compensate for the increased risk.

Loan amount and term: The amount of the loan and the loan term can also impact the bridging loan rate. Larger loan amounts or longer loan terms may come with higher interest rates due to the lender’s greater exposure and risk.

Type of bridging loan: Two primary types of bridging loans are open bridging loans and closed bridging loans.

Open bridging loans do not have a fixed end date, making them more flexible but often more expensive due to the uncertainty of repayment timing.

Closed bridging loans have a precise end date, typically when the borrower’s current property is under contract for sale. These loans may have lower rates since the repayment timeline is more specific.

How to compare bridging loan rates

When comparing bridging loan rates, it’s essential to look beyond the headline interest rate and consider the total cost of the loan, including fees. Here are a few tips for comparing rates effectively:

Check the comparison rate

The comparison rate includes the interest rate and any fees or charges associated with the loan, giving a more accurate picture of the overall cost of the loan.

Ask about additional fees

Bridging loans may have additional fees, such as application fees, valuation fees, and legal fees. Ask the lender about all potential costs upfront to avoid surprises.

Consider the loan’s flexibility

While a lower rate might be attractive, it’s also essential to consider the flexibility of the loan. A more flexible loan with features such as interest-only payments or flexible repayment options may be worth paying a slightly higher rate, especially if it aligns with your financial situation.

How Funding’s bridging loans can help property buyers

At Funding, we understand that property buyers need flexibility and speed when making decisions. Our bridging loans provide property buyers with a fast and efficient solution to finance their next property purchase while they wait for their existing property to sell. Here’s how Funding’s bridging loans work:

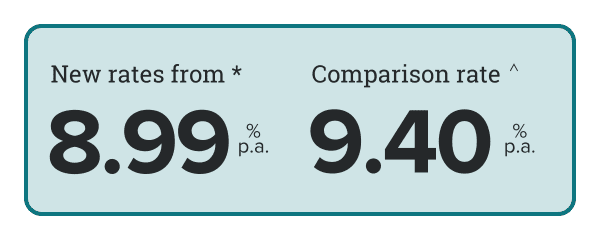

Competitive rates

We offer competitive bridging loan rates that provide value to property buyers without sacrificing flexibility. Our rates are structured to reflect market conditions while ensuring you get the support you need to smooth your property transition.

Fast approvals

At Funding, we use innovative technology to streamline the loan application and approval process. This allows us to offer fast approvals—typically within a few days—so you can secure the funds you need without unnecessary delays.

Interest-only repayments

Our bridging loans help you manage your cash flow during the transition period. With interest-only repayments, you can focus on purchasing your new property without the immediate financial burden of repaying the total loan amount.

Flexible repayment options

We offer flexible repayment options that allow you to repay the loan once your current property is sold. If necessary, we also provide refinancing options to help you transition to a long-term loan.

Funding bridging loan rates

Case study: How a bridging loan helped a property buyer secure their dream home

Sarah is a property buyer from Sydney who found her dream home in a competitive market. However, she had not yet sold her current apartment, and she was concerned that the property would be sold to another buyer before she could secure the funds. Sarah approached Funding for a bridging loan to cover the new home purchase while awaiting the sale of her apartment.

With Funding’s bridging loan, Sarah was able to:

Purchase the new property quickly: The fast approval process allowed Sarah to secure her dream home without waiting to sell her apartment.

Manage cash flow with interest-only payments: The bridging loan allowed her to make interest-only payments during the loan term, reducing the financial pressure while she waited for her apartment to sell.

Sell her apartment at the right time: The flexibility of the bridging loan allowed Sarah to wait for the right buyer and sell her apartment at a favourable price, ensuring she didn’t rush into a sale.

Once Sarah sold her apartment, she repaid the bridging loan in full, allowing her to transition smoothly into her new home.

Get started

Bridging loans offer a flexible and practical solution for property buyers who must act quickly in a competitive market. Understanding bridging loan rates and their influencing factors is essential for making informed decisions about your property financing.

At Funding, we provide competitive rates, fast approvals, and flexible repayment options to help property buyers confidently bridge the gap between buying and selling.

Learn more

For additional resources and information on bridging loans and property financing, explore these helpful links:

Downsizing your home: how bridging loans can lessen the stress

Tips for managing property transitions: leveraging short-term finance for savvy borrowers